Firmographic Data and Laser Focused Marketing

“Our institution is looking for ways to collect, organize, and analyze information about potential business clients that can be used to improve the quality of services and improve operations and business development efforts” Central California Banker

What is Firmographics Data?

Firmographics refers to the characteristics that are used to describe and categorize businesses within your market area.

These characteristics can include industry classification, company size, location, revenue, and other metrics that can help to provide a more detailed understanding of a company and its operations. Firmographics are similar to demographics, which are used to describe the characteristics of individuals, but are focused on businesses instead.

Firmographic data is often used by financial institutions to better understand the composition of their geographic market and to develop targeted marketing and business development strategies. By analyzing Firmographic data, financial institutions can identify common characteristics of their customers and create more effective marketing campaigns, sales pitches and business development programs.

Firmographic data can be gathered from a variety of sources, including public data sources such as government databases, surveys and interviews with customers, and from data brokers who specialize in collecting and selling business data. This data can then be analyzed using various tools and techniques such as data visualization, statistical analysis, and development of algorithms to identify patterns

If you're looking to better understand the characteristics of your business customers, a Firmographic analysis can help. It involves gathering and analyzing data on a customer and non-customer company's characteristics, such as industry, size, location, and revenue. This type of analysis is useful for identifying patterns and trends in the data and can be used to develop targeted marketing and sales strategies.

If you want to increase your business market base – follow these five easy steps

- The first step of conducting a Firmographic analysis is to visualize your market by using GIS mapping software like Maptitude Mapping Software. The GIS software helps identify patterns and trends that may not be immediately apparent when looking at raw data.

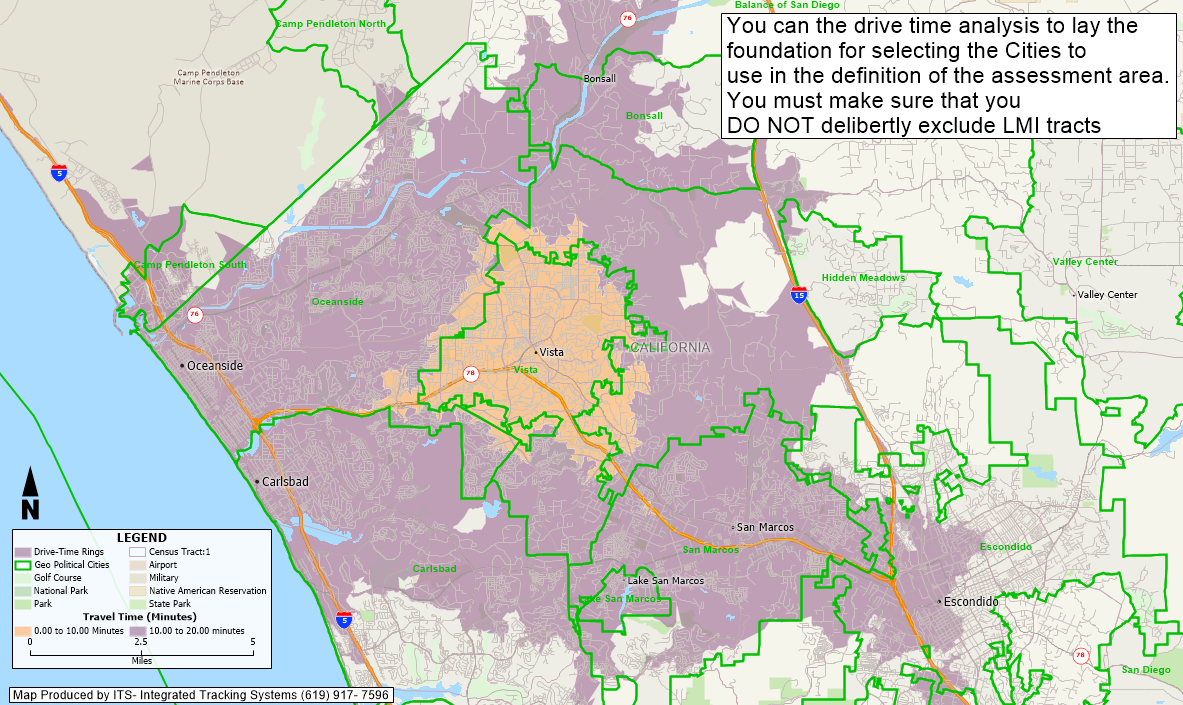

- As part of this visualization we need to define you Primary Service Area(PSA). This is the area where the majority of your business customers originate. We often use a Drive Time Analysiswhich looks at uses actual street networks and approximate driving times to the office facility.

- Next we'll use statistical software to analyze correlations and other relationships between different Firmographic variables. This allows us to identify patterns and trends present in the data more easily.

- Cluster Analysis in GIS, is a technique used to group similar companies together based on their company characteristics and visualize where the concentration are geographically. This can help to identify patterns and trends in the data and can be useful in developing targeted marketing and sales strategies.

- Regression analysis, a statistical method, that allows us to analyze the relationship between two or more variables. This can help to identify trends and patterns in the data and can be useful in predicting future outcomes based on past data .

How you can use Firmographics

Now that you know what Firmographics are, let's talk about how they can be used to improve your banks segmentation strategy:

- Targeted marketing: Understanding a company's industry and size can help financial institutions to create targeted marketing campaigns that speak directly to their needs. For example, a small business may require different financial solutions than a large corporation, so messaging and marketing materials should reflect that.

- Customized offerings: Institutions can use Firmographics to create customized offerings that cater to the unique needs of different segments. For example, a bank may offer specialized lending products for startups or tailor their cash management services to fit the needs of mid-sized businesses.

- Location-based targeting: As long as there is no discrimination in the service offerings, Banks can also use Firmographics to target companies based on their location. For example, a bank may offer specialized services to companies located in a particular region or city, such as courier services.

- Improved customer experience: By using Firmographics to segment their customers, banks can provide a more personalized customer experience. By understanding a customer's unique needs and preferences, banks can provide more relevant recommendations and solutions

GISBanker offers Customer data enhancement services that can help you target potential customers and understand your best customers better than ever before.

GISBanker has established relationships with several third party data providers, including Equifax, Claritas, Data Axle, Hoovers D&B, TransUnion, and Alesso Data.Moreover, we have the experience and knowledge to select the best data for your project, and provide statistical and analytical assistance to help you create market driven segments, build profiles and models that describe your best customers and the relationship to your products and services.

If you are interested in knowing more about our service, please contact us here:

Steve Bouton, Director (619)917-7596 for more information. Or Click here to email for more details