Strategic Marketing Analysis

GIS (Geographic Information Systems) is an effective tool to help institutions visualize, analyze and understand market factors and their relationship to the institution. It allows for the integration of information from different sources based on spatial connection of the data.

GIS works on the “layering” information, as shown, and it allows for the integration of information from different sources based on the spatial connection of the data.

The use of GIS can play an important role in various practical areas such as: Expansion of Customer Base, Improvement in Quality and Delivery of Services, Increased Customer Satisfaction, Consistent Business Growth, and Increase in Profitability. GIS helps by providing support in decision-making and strategic planning. Some of the major areas are discussed below.

Customer Analytics - GIS can help answer questions like: Where are our customers located, by account type? What are their characteristics (market segmentation, classification of residential areas)? Business Cluster Analysis, and Hot Spot Analysis, to target specific areas with desirable business clusters.

Comprehensive Business Analysis- Click here to learn more

Business Market Summary - Click here to learn more

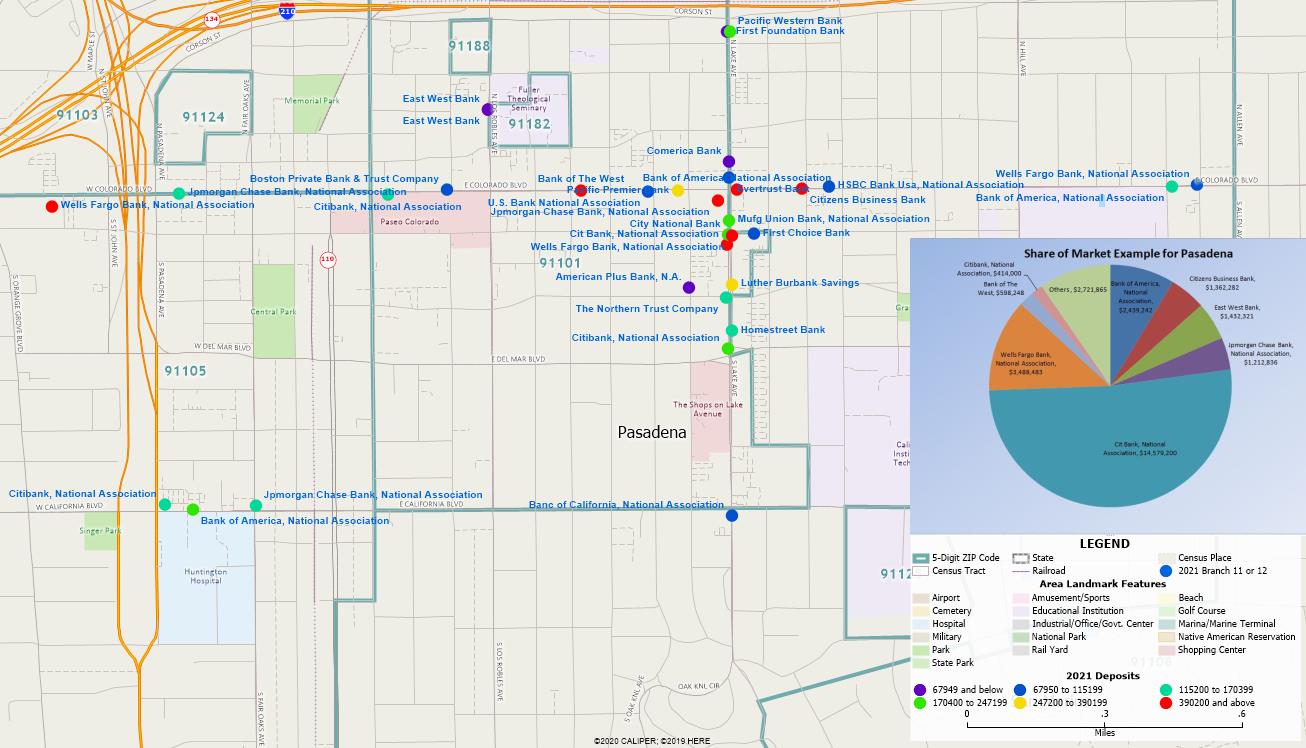

Competitive Analysis - using FDIC branch data and FFIEC LAR data, GIS can help visualize and understand the competitive

environment for your bank. It can help answer questions like: Where is your competition located? What is the deposit base of that specific location?

Using LAR data, what is the banks loan distribution within your market. This map summarizes the competition in Pasadena California based on FDIC deposit data.

environment for your bank. It can help answer questions like: Where is your competition located? What is the deposit base of that specific location?

Using LAR data, what is the banks loan distribution within your market. This map summarizes the competition in Pasadena California based on FDIC deposit data.

Defining GAPs in the delivery of services based on areas which are not being served.

Branch Performance Monitoring - GIS can add depth to the analysis of a branch performance. By adding the spatial components of: demographic, business composition, competition within a defined trade area will have a greater advantage. Potential customer "Hot Spot Analysis", by customer or account types, can be based on the spatial distribution of the customers. The GIS component of a branch review involves defining a trade area around the branch, measuring the market potential within that trade area, and identifying the nearby competitors. The banks can determine the products that are being purchased by particular socio demographic groups or business clusters. Based on this type of performance analysis, banks can determine other areas with similar influences to target specific advertising and branch expansion.

Define Service Areas or Trade Areas - GIS allows bankers to understand and define an “effective” service area for a branch, based on a variety of factors including: distance to an office for any customer and Drive Time Analysis,– To calculate the effective drive time, GIS looks at traffic patterns, traffic counts and speed limits for a location to calculate drive times. Location analytics provides information about issues of convenience for different market segments. For example, loan customers may be willing to drive farther then deposit customers. It also can produce a wide variety of information about the demographics, business characteristics, target market segments and more.

Defining Assessment Areas- Click here to learn more

These are just few examples of the application of GIS in banking.

The following 2 minute video describe the process for Credit Unions.

If you are interested in knowing more about our service, please contact us here:

Steve Bouton, Director (619)917-7596 for more information. Or Click here to email for more details